Bitcoin is misunderstood, under-appreciated, and polarizing. Bitcoin is also amazing. Due to its nature as a misunderstood and polarizing asset, people are typically against Bitcoin before they are for Bitcoin. The cool thing about all of this is that one can foresee that a person who is against Bitcoin, does not understand Bitcoin. Those who understand Bitcoin, buy Bitcoin. Those who do not understand Bitcoin, criticize Bitcoin. Those who understand Bitcoin, buy Bitcoin, and hodl Bitcoin (hodl – hold on for dear life) reap the greatest gift that Bitcoin brings: peace.

From Humble Beginnings…

I do not remember when I first heard about Bitcoin. It must have been sometime in my later years of high school (circa 2011-2013). I have been a Redditor since 2011 and had been involved in internet communities for many years before that, so I am sure that I stumbled upon it at one point or another. Nonetheless, I began to hear about Bitcoin a bit more while in college (circa 2016) as a classmate and friend of mine owned some and would talk about it occasionally.

However, it was not until 2021 that I made my first Bitcoin purchase and officially entered the space. At the time I had some money to invest and decided to get into Bitcoin mostly for the meme, and would occasionally make small purchases every few months or so. I think calling myself a Bitcoin investor would have been a bit of an exaggeration. I did not understand it and was simply buying it for the hell of it.

Fast forward to 2024 and I would now consider myself a Bitcoin maximalist. I have been dollar-cost-averaging into Bitcoin for some time, and also make regular larger purchases. After spending hundreds upon hundreds of hours educating myself on Bitcoin, blockchain technology, economics, and the global financial system, it is impossible to make more sense nor be more clear to me that Bitcoin is the best asset and the best thing to buy with my hard-earned money.

Before understanding Bitcoin, investing carried mental stress and baggage. After understanding Bitcoin and having the conviction that it is simply the best thing to buy and hodl, the stress goes away, and the worrying goes away. Taking over in their place is simply peace of mind.

Do Not Waste Your Time Trying To Time

Any wise investor will tell you that time in the market beats timing the market. This holds true also for Bitcoin. However, one of the cool things about Bitcoin in 2024, is that it is still so incredibly early to get in and become a part of a rapidly growing network. It is foolish to try to time Bitcoin and time your entry point. For one, you will probably be wrong. But more importantly, the more time that you spend in the Bitcoin network and accumulating it, the greater your wealth (and peace-of-mind-ness) will be in the future.

I Promise I’m Not Crazy…

For those reading who are unfamiliar with Bitcoin, you will probably scoff at the next sentence. Bitcoin brings peace because it is the least risky asset. Do I sound crazy? Hang with me for a second. Bitcoin is the only asset that offers zero counterparty risk. Real estate, stock and equities, and bonds all carry counterparty risk, some more than others. How much do you trust banks? Governments? Companies? Bitcoin is a true bearer asset and cannot be taken or stolen from the bearer.

It may not be entirely relevant for most people, but something amusing to think about is that Bitcoin is also the only thing in the world that someone would be disincentivized to kill you in order to take it from you. A criminal can kill you or threaten you with death to take your watch, your car, your bars of gold. But killing someone kills the ability to take someone’s Bitcoin, plain and simple. Any chance of getting someone’s Bitcoin dies with them.

It’s going to zero or it’s going to a million

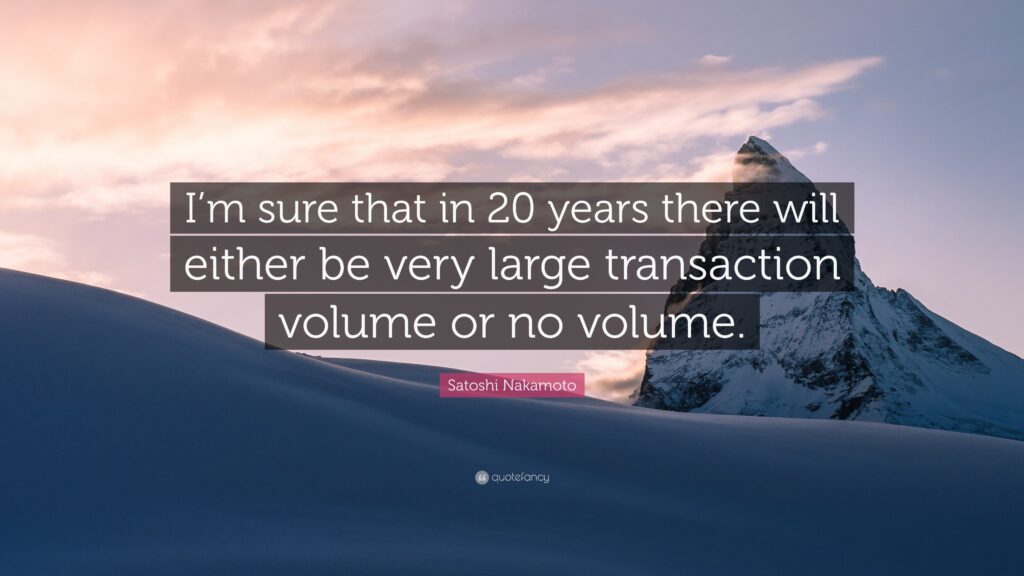

In a world such as ours, where governments and their central banks have unrestricted free rein over their currencies, it would be foolish to think that we would not continually and systemically increase the money supply and dilute the savings and wealth of our own citizenry. Thankfully, we have Bitcoin. In the quote above, Michael Saylor is entirely correct. Bitcoin as an asset, when measured in US dollars, will go to zero, or it will go to 1 million (and higher). Bitcoin is now 15 years old. While it’s relatively young, it is quickly and ruthlessly growing in size and eating everything in its path.

As of this writing, the Bitcoin network is the 10th largest asset in the world by market capitalization. At $1.28T, it is sandwiched between Berkshire Hathaway and Meta (Facebook). Bitcoin daily transaction volume is in excess of $30B daily. In other words, 30 billion dollars of value are being transacted on the Bitcoin network daily. For a protocol that is a teenager, that is insane.

As more and more people learn about and understand Bitcoin, these already large numbers will only continue to become larger. It is not a question if governments will continue to inflate their currencies and monetary bases (how else will they pay for the ever increasing debt?) but it is a question of when and how much they will create.

It’s Physics, Really

Bitcoin is the hardest and soundest form of money in existence, and as more economic energy is created, it will naturally flow to Bitcoin. With an understanding of the bigger picture, I peacefully and comfortably continue to accumulate Bitcoin, as I know that by zooming out and ignoring the noise of short-term price volatility, Bitcoin’s value will only go up.

I once read that “Bitcoin is everything people don’t understand about money, combined with everything people don’t understand about computers”. If you have any questions about Bitcoin or anything that I wrote about, please comment below!